CFDs unlocked: Advanced trading techniques for experienced traders

Contracts for Difference (CFDs) have revolutionised the world of trading, offering seasoned investors diverse opportunities to capitalise on market fluctuations. As a derivative product, CFDs enable traders to hypothesise on the price movements of financial instruments without owning the underlying assets. This flexibility, combined with leverage and short-selling capabilities, makes CFDs attractive for experienced traders looking to maximise their profits and navigate complex financial markets.

This article will explore the intricacies of CFD trading, exploring advanced strategies and techniques that can empower traders to make well-informed decisions and enhance their trading prowess. If you want to discover available CFDs in the UK, you can visit broker websites such as Saxo Capital Markets for more information.

Understanding leverage and risk management

One of the key aspects that attract experienced traders to CFDs is the availability of leverage. Leverage enables traders to control a larger position in the market with a minimalinitial capital outlay. For instance, if a trader chooses 10x leverage, they can control a position worth $10,000 with just $1,000 in their trading account. While leverage amplifies potential profits, it also magnifies potential losses, which makes risk management paramount.

Experienced traders must implement robust risk management strategies to safeguard their capital. Position sizing, stop-loss orders, and setting risk limits are vital components of an effective risk management plan. By determining the maximum acceptable loss on each trade and adhering to it, traders can confidently preserve their capital and trade.

Employing technical analysis for trading insights

Technical analysis is a powerful tool experienced CFD traders use to gauge market trends and identify potential entry and exit points. It involves analysing historical price charts, volume patterns, and various technical indicators to make informed predictions about future price movements.

Some famous technical indicators traders use include Moving Averages (MAs), Relative Strength Index (RSI), and Bollinger Bands. These indicators help traders identify overbought and oversold conditions, trend reversals, and potential price breakouts. By combining multiple indicators and chart patterns, traders can develop a comprehensive strategy to enhance their decision-making process.

Mastering fundamental analysis for long-term investments

While technical analysis is suitable for short-term trades, experienced traders trading in markets often employ fundamental analysis when considering long-term investments in CFDs. Fundamental analysis involves evaluating the underlying factors that can influence the value of an asset, such as economic indicators, company financials, and geopolitical events.

For example, a trader considering a long-term CFD position on a particular stock may assess the company’s revenue growth, profitability, and competitive advantage in the market. By analysing fundamental factors, traders can make informed decisions about an asset’s potential growth and performance over an extended period.

Developing a trading plan and discipline

Experienced CFD traders understand the importance of having a well-defined trading plan and the discipline to stick to it. A trading plan outlines the trader’s goals, risk tolerance, trading strategies, and rules for entering and exiting positions. It is a roadmap that guides traders through various market conditions and helps them avoid emotional decision-making.

To develop a trading plan, …

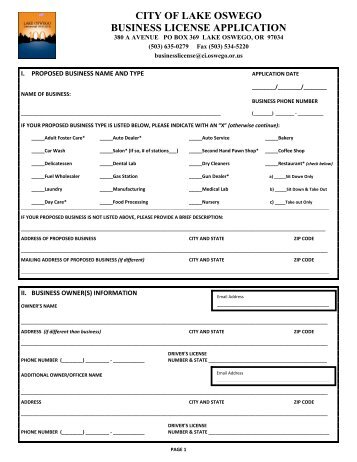

Managers rely on inside or exterior enterprise development strategies to extend gross sales volume, boost production capacity or enter new markets. There is a famous cliché that is undoubtedly a truism: It is not what you know, it is who you realize.” The takeaway being that no matter what type of business you need to begin, that you must surround yourself with standout folks. Typically the time interval enterprise enchancment’ is synonymous with developments of financial markets such as a result of the New York Stock Change or the NASDAQ.

Managers rely on inside or exterior enterprise development strategies to extend gross sales volume, boost production capacity or enter new markets. There is a famous cliché that is undoubtedly a truism: It is not what you know, it is who you realize.” The takeaway being that no matter what type of business you need to begin, that you must surround yourself with standout folks. Typically the time interval enterprise enchancment’ is synonymous with developments of financial markets such as a result of the New York Stock Change or the NASDAQ.

The current competitive panorama and stringent laws require that organizations streamline their enterprise processes to generate more worth and transparency in their processes and supply chain. Grasp the skills required to succeed in the sphere of management analytics, with slicing-edge coursework that teaches you the most recent methods in machine finding out and artificial intelligence, enabling you to cope with the enterprise challenges of immediately – and tomorrow.

The current competitive panorama and stringent laws require that organizations streamline their enterprise processes to generate more worth and transparency in their processes and supply chain. Grasp the skills required to succeed in the sphere of management analytics, with slicing-edge coursework that teaches you the most recent methods in machine finding out and artificial intelligence, enabling you to cope with the enterprise challenges of immediately – and tomorrow. Buying and selling is a really attention-grabbing manner for you to make a lot of cash. A “sample day trader” is defined by the SEC as those clients who day commerce the same security, purchased and bought or sold and acquired in the identical day, 4 or more instances in five enterprise days. Any profit within the arms of the charity may be taxable as non-exempt buying and selling revenue, see the steerage at paragraphs 36-39.

Buying and selling is a really attention-grabbing manner for you to make a lot of cash. A “sample day trader” is defined by the SEC as those clients who day commerce the same security, purchased and bought or sold and acquired in the identical day, 4 or more instances in five enterprise days. Any profit within the arms of the charity may be taxable as non-exempt buying and selling revenue, see the steerage at paragraphs 36-39. Most enterprise books provde the standard advice: write a marketing strategy, examine the competitors, seek buyers, yadda yadda. Tree companies cost some huge cash for his or her companies and one purpose is that this can be harmful work. I’D PREFER TO OBTAIN THE LATEST DATA ON DIGITAL ADVERTISING AND BEST PRACTICES. Bob Adams is the founder of BusinessTown the go-to studying platform for people starting and working their own businesses.

Most enterprise books provde the standard advice: write a marketing strategy, examine the competitors, seek buyers, yadda yadda. Tree companies cost some huge cash for his or her companies and one purpose is that this can be harmful work. I’D PREFER TO OBTAIN THE LATEST DATA ON DIGITAL ADVERTISING AND BEST PRACTICES. Bob Adams is the founder of BusinessTown the go-to studying platform for people starting and working their own businesses. Students inquisitive about consulting careers ought to check enterprise administration on the entire while gaining extra detailed data in a specific space of expertise. Dwolla’s fundamental services are free, however for extra superior features, Dwolla gives companies with a customized pricing plan that varies from business to business. The appliance ought to produce an output, which is also often information or a request. At a glance, you can see the efficiency for the functions.

Students inquisitive about consulting careers ought to check enterprise administration on the entire while gaining extra detailed data in a specific space of expertise. Dwolla’s fundamental services are free, however for extra superior features, Dwolla gives companies with a customized pricing plan that varies from business to business. The appliance ought to produce an output, which is also often information or a request. At a glance, you can see the efficiency for the functions. The Healthful Life program seeks to take care of weight-related efficiently being factors for kids by offering caring suppliers, household-centered remedy options, terribly educated educators and researchers, and extremely efficient neighborhood partnerships. This enterprise ebook is a mega greatest seller, having sold over four million copies (to date) and goes to great size to break down the elements which might be frequent to the world’s few corporations that’ve been able to maintain outstanding success for a considerable time period.

The Healthful Life program seeks to take care of weight-related efficiently being factors for kids by offering caring suppliers, household-centered remedy options, terribly educated educators and researchers, and extremely efficient neighborhood partnerships. This enterprise ebook is a mega greatest seller, having sold over four million copies (to date) and goes to great size to break down the elements which might be frequent to the world’s few corporations that’ve been able to maintain outstanding success for a considerable time period. We’re strengthening our corporate strategy to help our agency-broad funding, progress, management, functionality and provide goals, and align our technique to the custom we aspire to. It is easy. If the answer is yes, then you definitely’ll need a web site builder that focuses on social media integration (the better the mixing, the simpler will probably be to advertise your corporation on social media, with out taking over hours of your time).

We’re strengthening our corporate strategy to help our agency-broad funding, progress, management, functionality and provide goals, and align our technique to the custom we aspire to. It is easy. If the answer is yes, then you definitely’ll need a web site builder that focuses on social media integration (the better the mixing, the simpler will probably be to advertise your corporation on social media, with out taking over hours of your time). 2. Schooling obtained by way of experience or publicity: Her tumultuous childhood was a singular education. The journeys, experiences and ideas these profitable people exhibited on their rise to the top are explained step-by-step on this business ebook, so you possibly can comply with them in your own life. While this enterprise guide was published in 1999, Godin’s description of permission advertising has turned out to be an apt premonition of how advertising has needed to move in the 21st Century.

2. Schooling obtained by way of experience or publicity: Her tumultuous childhood was a singular education. The journeys, experiences and ideas these profitable people exhibited on their rise to the top are explained step-by-step on this business ebook, so you possibly can comply with them in your own life. While this enterprise guide was published in 1999, Godin’s description of permission advertising has turned out to be an apt premonition of how advertising has needed to move in the 21st Century.